As entrepreneurs, we all understand that cash is the lifeblood of your business. However to ensure that lifeblood continues to pump through your business, you really need to understand the foundations of business cash flow management.

To understand the lifeblood of your business, you need to first understand what is cash flow then of course where you can find cash hiding in your business and then use that information to improve your cash flow.

Cash flow might be simply the money going in and out of your business, however cash flow management is vital to the continued operation of your business. You know you may be able to operate without profit for a little while, however you cannot operate without cash.

Your cash flow position

To begin improving your cash flow management, you must start by understanding your cash flow. It helps to understand what is going in and out of your bank account, and you do this by simply putting together your cash position. Start by identifying your cash inflows, the majority of your cash will be received from your customers some of them may pay you at the time of sale this is referred to as a cash sale.

Sales paid by credit card are also considered cash payments. Some of your customers may be on account, that means instead of receiving cash you gave them an invoice to pay you sometime in the future. We call these customers debtors or accounts receivable. Now you may also have some other income such as interest or dividend income or maybe some subsidies or grants. This also needs to be included.

Once you have all of your inflows, you then need to identify your cash outflows. These will include your suppliers who are also called creditors or accounts payable. You put in all your general expenses such as electricity, office lease, accounting fees and all your overheads. Of course, if you have employees you put in their wages and salaries and if you have borrowings you include the interest and principal repayments.

Don’t forget to include the other expenses you have, particularly the ones that happen infrequently like paying GST, PAYG, superannuation, insurance, vehicle lease, etc. Now take away your outflows from your inflows to give you your ending cash position. Once you have your ending cash position, you will have one of three results. Don’t worry about what result you get as they are about your cash flow not about the profitability of your business.

“Never take your eyes off the cash flow because it’s the lifeblood of business.”

—Sir Richard Branson

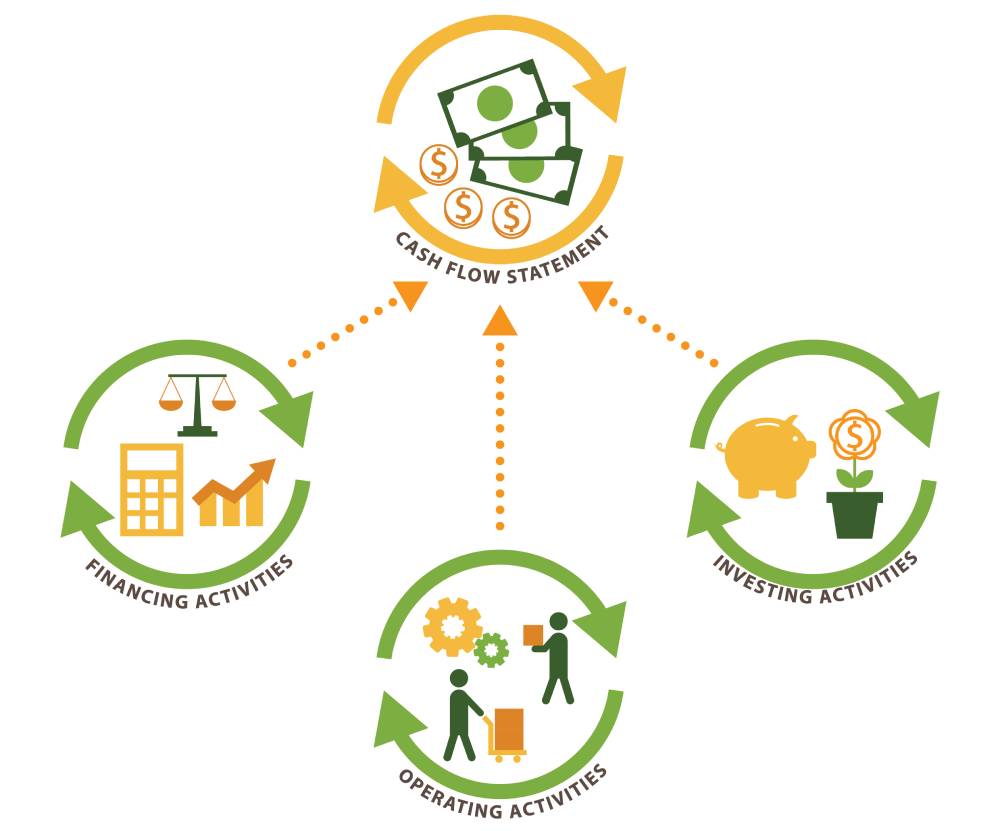

Types of cash flow

Firstly, a positive cash flow. If you consistently have positive cash flow, this gives you opportunities you know you can opt to spend it now to take advantage of a current opportunity, you could save the cash to pay future bills or cover future negative cash flows or you could even invest the money into growing your business.

Secondly, a neutral cash flow. A neutral cash flow means you do not have to find any more money to fund your business, however it also means your opportunities to spend, save or invest are very limited.

The third outcome is a negative cash flow. Now, don’t panic just yet it may only be a short-term problem. This does not mean there is anything wrong with your business. All it means is you need to find the cash to cover it now you might get that cash from your own pocket. You may take on a partner who injects cash into your business or you may need to come talk to a bank and borrow the money.

Cash budget

The information you gather for your cash position will help you to put together a cash budget for your business, which will help with cash flow management. Now a cash budget I think is one of the most useful tools to understand and manage the cash in your business and you should do your cash budget at least monthly.

Of course, you can do it more often if you want. You start out with your beginning cash. You know that is the cash sitting in your bank account, then you add to it all the cash you expect to come into your bank account that month from your cash sales debtors and any other cash you think you may receive. Of course, you’ll need to factor in timings such as how regularly your debt is paid; is it the same month as you invoice or is it sometime after that?

In your beginning cash to the cash you expect to receive will let you know how much cash you have available to pay for your outflows for that month. You then need to put down how much you think you will pay out each month to your suppliers, which are also known as your creditors. You must include all your general expenses like your rent, advertising, consumables, cleaning and maintenance and so on. Once again, don’t forget your GST and tax payable with your statement and of course things like insurance which may only be paid once per year.

As I said previously, if you employ people you’re going to need to include their wages and salaries and of course their PAYG payments and super. Any debt repayments you may have including principal repayments the interest on that debt and any leases that you have also need to be included and of course any other payments you may make such as dividends or owners drawings.

Once you have a cash budget, you can then decide the best ways to treat either a positive, neutral or negative cash flow position. Now that we understand the basis of cash in and cash out, we now need to understand a little more about the timing of cash flow and of course where the cash may tend to pool or hide in your business, to improve your cash flow management.

Working capital cycle

A great way to understand where cash hides in your business is a concept called the working capital cycle. Now every business has a working capital cycle, however I’ve got to tell you, they’re not all the same. What I’m going to do is I’m going to start with a generic cycle and then I’ll talk about some variations to these. We start off with the money sitting in your bank account.

Now your money sitting in your bank account is no good to you. You actually want to use that cash to help you make profits. However, to do this you first need to buy something that you can sell.

In this case, we’re going to take the cash out of the bank account and go and buy some stock. The stock comes in and we fill up our store or our warehouse or a garage at home you know wherever we put this stock. Now if you’re in a business that does have stock, one of the things I’d like you to do it sometime in the next couple of days is go stand in the middle of your stock, close your eyes and imagine that stock is bags of cash. However they are bags of cash that you cannot use. You cannot use this cash until you sell the stock.

Now for some of us, when we say that stock, we get our cash straight away either as cash or as credit cards. For others though we issue invoices and end up with things called debtors or accounts receivable. This is where you become the banker to your customers. What you are doing is you are lending your customers the money to buy your goods or services.

Then what happens? We hope these debtors, these customers of ours, pay us and that dollar comes back into our bank account. Now, why are we interested in this cycle? Well because your cash flow management is dependent on how long it takes for your dollar to go all the way around the cycle.

Now if you can turn your dollar faster around the cycle, it may do one of three things for you. The first is if you turn the cycle around faster, you end up with more cash back in your bank account. That’s more cash that you can do other things with. The second thing is if you are using an overdraft for the bank to fund your working capital cycle.

You may be able to reduce your overdraft, because you’re turning your cycle faster. The third thing is that it supports business growth. When you grow a business, you need more stock, however if you turn this cycle faster you don’t need as much more stock or as much more debtors.

So you can grow faster without chewing up as much cash. It’s all about how fast can you turn your dollar around this cycle. So how do we know how fast our working capital cycle is spinning? Well we usually measure the speed or the turns in days, you know how many days on average does that stock sit on the shelf wall before you sell it? How many days on average does it take you to collect your debtors?

The turns are of course time, and time of course is money. Turning your working capital cycle faster will free up your cash. I said at the start of this, that not all businesses are the same. the retailers out there are looking this and saying well hold on, I get everything in cash and credit cards. I don’t have debtors.

You’d be absolutely correct; your cycle just goes from cash in the bank to stock and back into cash. You know that’s a bit simpler, however I must say the biggest killer of retailers, no matter where you go in the world, is poor management of stock.

A bill comes in, you can’t pay it because all your cash is tied up in the stock on the floor, you’ve got to turn your stock and make sure your cash is working for you. Now, I know others of you are sitting in and saying well hold on a second, I’m a service business and I don’t have stock and again I’m going to agree with you. However, I’ve got to say you do have something that’s a little bit like stock, it’s called WIP or work-in-progress.

Basically, you take on a job from a customer, you do all the work for them and then you send out an invoice. Well, while you’re doing all that work, before you can send out that invoice, what do you have to pay out of your wages? Do you have to pay rent? Do you have to pay out for any general overheads? If you do, then it’s chewing up your cash. The cash of course is then further chewed up when you send out an invoice. Then you have to wait for your dollar to come back into the bank account.

I must admit for many businesses it can be a combination of all three of these things or perhaps having different cycles in different parts of the business, which of course is even more challenging to manage. However whatever business you’re in, you have a working capital cycle and it’s really important to understand how the cash flows through your business, so that you can find where your cash is hiding and free it up.

Cashflow management cycle

Cash flow management tips

We now know how your cash flows, and that if your working capital cycle slows up, it can cause your cash to pool or hide instead of flowing. Now, we need to work out how to get your cash flowing again. To do this, we’re going to look at each element; stock, work in progress, and debtors of their working capital cycle and the actions that you may be able to take to improve your cash flow.

A very common place that cash can hide in your business is in stock. So let’s start there. Now the stock pool is a brainstorming tool to help you identify where you may be able to free up some cash. The stock pool is basically like a big swimming pool, where all your stock is sitting. To fill up this pool with stock, you first need to purchase it. So you’ve got purchases coming in and it’s filling up your pool and it’s making it bigger and deeper. How do you empty this pool? By selling the stock. You know I sell off the stock to empty it.

Now, in a perfect world we would love for our purchasers to arrive on the day we got the stock, and in effect we would just have a stream rather than a pool. However, for most of us, we’re not in a perfect world, so we do end up with this stock pool. So if your stock pool is getting larger and chewing up a lot of your cash, you really need to start working out how to shrink it back down again. To shrink your stock, there are two options; you can either slow down purchases or speed up sales.

Now I’m not going to concentrate on sales, as every business owner I know is already doing everything they can to speed up their sales. We’re going to mainly concentrate on purchases as purchases is likely the place that you’re going to free out the most cash. This brainstorming tool is really just that; getting you to think about how to reduce your purchases, and how to get your purchases as close to a just-in-time system as you can.

Now I’m going to put up a few ideas here to help. You can look at the different types of stock that you’re holding. This is known as your product mix. If you’re holding lots of different types of stock, you might find that some it is turning around really fast and other pieces of stock are taking a long time to sell. Now this does not mean you get rid of the ones that are slow-moving, however it does mean that you look at them and ask yourself why do I carry this slow-moving stock?

Now there’s only two reasons; one is it has a lot better profit margin on it than anything else you sell, and that extra profit margin covers the cost of holding it for longer. The second reason you might hold slow-moving stock is it brings people in to buy your fast-moving stock.

Now take a look at your mix, if it’s not doing one of those two things, then it may be best to get rid of that slow-moving stock. Another option to help out our stock pool is to outsource. Will your suppliers hold on to the stock, and not charge you for it until you need it? You could also take a look at your stock recording system. Can you improve your system? Does your system tell you how much stock you’ve got at any point in time?

Do you do regular stock takes and match it to your system? Can your system let you know when you need to reorder? Pipeline management can also be used to help manage your stock. Do you have a sales forecast that takes into account your seasonal variations? A good sales forecast will allow you to put in place a purchasing budget.

When putting your budget in place, you really need to take into account your supply delivery times and minimum order quantities, to make sure you’re making the best use of your cash. Most businesses would need to have only enough stock to meet their sales. Now you might also notice here don’t buy as an idea. I’m going to say this of course, it’s just a temporary solution we use to get your stock down to the correct levels before we start buying again.

Buy less, more often

I must admit the one cash flow management strategy I really love here is buy less, yet more often. Let me give you an example here. When I was growing up, my mother would buy her cheese in 2kg blocks at a discounted price, however the problem was that we could only eat about 1kg of cheese before it went mouldy, and then had to be thrown out.

So effectively, my mother wasn’t getting a discount; she was paying more per kilogram, and buying in bulk chews up your cash and takes up more space. I’m a big believer in buying less, more often so that’s having a look at the purchases. Now I said most people are already doing as much as they can on the sale side, however I just want to have a quick look on the sales side at the stock they’ve already purchased that just isn’t moving.

Improve stock sales

What can you do with it? Well you can incentivise your staff by paying them commission or give them extra training. You could improve your marketing, maybe put it into a catalog or maybe put it out in a bargain bin at the front of your store. You could package it up and sell it with other products, maybe. You could sell it in a different market, such as on eBay or even sell for scrap. You should try everything you can to improve cash flow management and get cash for your dead stock.

Now, if none of these things are working and you’re still holding on to this stock, maybe you could see if you could donate it to a charity or a local school. That’ll give you a little bit of goodwill and PR, however at the end of the day write it off and dump it. Trust me, write it off sooner rather than later and there are two very good reasons for this. One is if you’ve got stock that is slow moving or isn’t moving, it’s taking up space that could be used for stock that does sell.

The second thing is it’s a bit more psychological one; every day you go into your business and you see that stock that’s not moving, it reminds me that you made a mistake buying it in the first place. These are just some of the ideas for shrinking your stock pool and freeing up your cash.

“balance sheets and income statements are fiction, cash flow is reality.”

—Chris Chocola

Work in progress

For service businesses, instead of stock you need to look at WIP or work in progress, to free up your cash, and improve your cash flow management. Let’s think about this work in progress and how it flows through your business. We start out with the time and skills, or if you like, the resources, needed to complete our contracts. These are, of course, mainly people, however they could also include equipment of which we use their skills and time to help complete jobs.

What we’re interested in is having the right amount of resources to complete jobs in the fastest time. Now you are usually paying for the time you have access to these resources however if you don’t use that time, you’ve lost that cash. So how do we make sure you have the right amount of time and skills to complete the work needed? Well I believe the first place to start is to have a pipeline management system that gives us a good indication of the jobs coming up and the skills, people, functions and equipment needed to complete them.

Of course, you need to hire the right number of people or equipment or space with the required skills or a combination of these things. You can look at is maybe using contractors part-time or casual staff instead of full-time employees, because this allows you the flexibility of increasing and decreasing your resources as the number of jobs change. You also need to know the capacity constraints of your resources. That is, how much work can they actually produce in what time frame?

You need to ensure the work being undertaken is productive. You know the income generating tasks or tasks that will obscure your resources for work in the pipeline. Also, ensuring your admin work is completed correctly. Are you effectively rostering your resources, ensuring that you are not using all your expensive staff at the same time or alternatively. All of your inexperienced staff at the same time? Can you ensure you are not carrying excess staff or equipment?

This stage of cash flow management is all about making sure you keep your employees and any other equipment that you may have busy and occupied on revenue generating activities. However the other side to having the right resources, is to ensure your jobs are completed on time. This gets back to efficiency. What we want to do is finish every job as soon as we can. So you have to make sure your processes are efficient. You have to make sure that your employees stay motivated and stay productive.

You know are there any obstacles or bottlenecks that are hampering completion of jobs. Is there a monitoring process in place so that you know what stage your jobs are at, and that you get an early warning when they may be going off track? Of course, part of monitoring is to know what is the time to completion and what keeps it all on track is the productivity of your staff and equipment.

If you are in a service business, you have work in progress, you really need to make sure you have enough jobs to keep everybody occupied. To keep all your capacity used and that it is all being done efficiently and productively so that you’re getting the jobs out the door as soon as you can.

The better you do this, the better your cash flow will be going forward. Of course the third place that cash can hide in your business, is in debtors and again we’re going to use the debtor pool as a brainstorming tool to help you identify where you may be able to free up some cash.

So we need to think about debtors just like we have with stock and work in progress. They are like a big swimming pool. We fill it up by making credit sales and we empty it by collecting the cash from our customers. Again, we have two sides to our debt problem so let’s first have a look at the credit sale side.

Credit terms and policy

When we started looking at credit sales, it’s all about who you give credit to and what are your terms or policy. So start by thinking about credit sales as if you are lending money to your customers to purchase your goods and services.

Then think about when you borrow money from the bank. What does the bank want to know about you before they lend you any money? Now the thing about what you find out about your customers before you lend the money? Because that’s essentially what giving credit is. I’d highly recommend you do reference checks and credit checks on your customers before giving them credit terms. You’ll know how good the money they are, and do they have a good payment track record.

Once you’re happy that they are good for the money and how much they’re good for, then you’ve got to start thinking about what your policy is and what your terms are. Make sure it is very clear to your customers what that policy is, by ensuring it’s communicated on your invoice. Now the policy may have things in it like you want cash in advance or you want the deposit paid upfront or you may want progress payments along the way. It may have in it that you want to be paid within seven days or 14 days or 30 days or even 45 days.

Whatever it might be, you’ve got to decide what your credit policy is. There is a word of warning here though; if you’re dealing with a government department or a large corporate, quite often you’ve got to deal with their policy and not yours. Because they’re so much bigger than you, they have their own way they’re going to pay people, which can affect your cash flow management.

What you need to do then is work out what is their process and then how does that impact your business. Work with it and don’t forget to price yourself appropriately for how their system works.

Chase debtors frequently

Now, a big part of cash flow management is once you’ve got the money out there and you’ve got your terms in place, then of course you’ve got to get the money to come back in. The first thing here is to ensure you send the invoice the same day you deliver the goods or deliver the service. You’ve got to invoice as soon as you can, so you can start your terms from that date. Now follow up is the biggest thing you’ve got to do. Get on the phone the day after they don’t pay. You’ve got to be on the phone asking where your cash is.

This is because there are a lot of creditors out there when they’re short of cash and they’ve got people to pay, who do they pay first? Well they generally pay the people who ring up and ask for the money first. So, if you only pay first you’ve got to ring up first. Emails are not good enough. You have to talk to someone, and of course when you’re talking to someone you need to develop the right contact to talk to, particularly if it’s a large organisation.

In a large organisation, the payments clerk probably has no authority to actually get your invoice out any earlier. Somebody else has that authority, so you need to find out who has the authority to speed up your payment. However, don’t forget that payments clerk because the payments clerk has a lot of work to do and if they see your invoice in there and they know you’ve been nice to them, then they’re more likely to put it on the top of their part to make sure you get paid.

It’s also good to make sure you’re aware of those who aren’t paying you on time. Now it can be a big job to chase up your debtors, however there is another option and that is to outsource your collections. You can send it out to an external data collection agency, where somebody else will ring your customers up and collect your money for you.

Another common technique is to incentivise your customers to pay early, however offering them a discount for early payment doesn’t mean you need to forego profits, if you build it into your pricing to start with.

Whatever it is, short of payment terms, a phone call, a discount; you want to make sure that you get your cash in as soon as you can. The sooner you get your cash in, the better your cash flow. Remember your cash hides in your working capital cycle. Monitor your cycle regularly and make sure it is turning as fast as your industry will allow.

“Revenue is vanity, profit is sanity, but cash is king.”

—Unknown

Improved cash flow management

Today we covered what is cash flow, remember the cash flow budget is one of the most effective tools to keep an eye on your cash flow. We had a look at the working capital cycle to see where cash may pool or hide in your business, and then of course we looked at a few ideas to actually get that working capital cycle moving faster and improve your cash flow management.