The Self-Managed Superannuation Fund (SMSF) tax return due date is a critical deadline for trustees and members of SMSFs in Australia. Generally, the due date for lodging the SMSF annual return is October 31st following the end of the financial year, which concludes on June 30th. This timeline is essential for ensuring compliance with the Australian Taxation Office (ATO) regulations.

However, it is important to note that if an SMSF has a tax agent, the due date may be extended to May 15th of the following year, provided that the tax agent is registered and has lodged the necessary paperwork with the ATO. Understanding this due date is not merely about adhering to a timeline; it also involves recognizing the implications of timely filing. The SMSF tax return encompasses various components, including income, expenses, and tax liabilities, which must be accurately reported.

Failure to meet this deadline can lead to significant repercussions, including penalties and loss of compliance status. Therefore, trustees must be proactive in their approach to ensure that all necessary documentation and financial records are prepared well in advance of the due date.

Consequences of Missing the SMSF Tax Return Due Date

Administrative Penalties

One of the most immediate repercussions is the imposition of administrative penalties by the ATO. These penalties can vary based on the severity of the breach and can accumulate over time, leading to substantial financial burdens on the fund.

Financial Implications

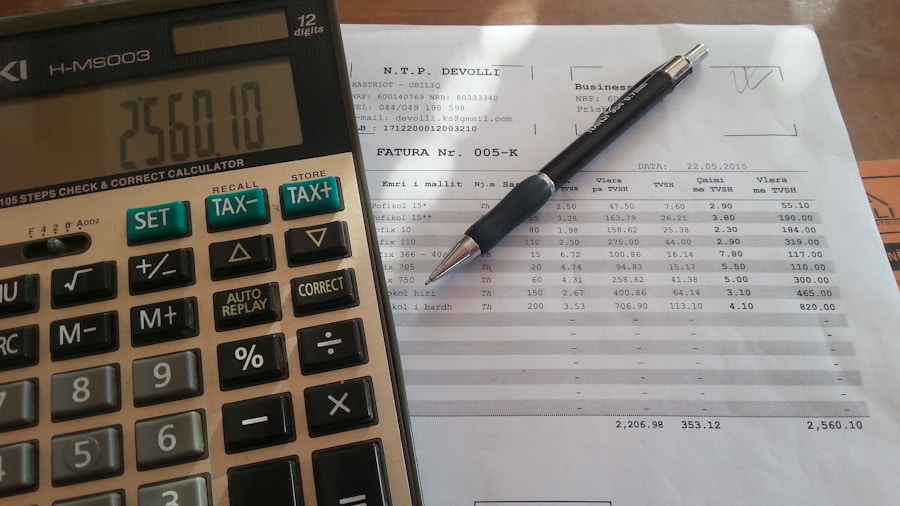

For instance, if a fund fails to lodge its return on time, it may incur a penalty of $1,050 for each 28-day period that the return remains outstanding, up to a maximum of $5,250. In addition to financial penalties, missing the due date can jeopardize the fund’s compliance status.

Impact on Members and Compliance

An SMSF that is not compliant may lose its concessional tax treatment, which can significantly impact its overall financial health. This loss of compliance can also affect members’ retirement savings, as they may face higher tax rates on their superannuation contributions and earnings. Furthermore, non-compliance can lead to increased scrutiny from the ATO, resulting in audits and further complications for trustees who may already be struggling to manage their fund effectively.

Steps to Prepare for the SMSF Tax Return Due Date

Preparing for the SMSF tax return due date requires a systematic approach that involves several key steps. First and foremost, trustees should establish a timeline that outlines all necessary tasks leading up to the due date. This timeline should include deadlines for gathering financial records, completing audits, and finalizing the tax return itself.

By creating a structured plan, trustees can ensure that they allocate sufficient time for each task and avoid last-minute rushes that could lead to errors or omissions. Another crucial step in preparation is ensuring that all financial records are accurate and up-to-date. This includes reconciling bank statements, verifying investment valuations, and ensuring that all income and expenses are properly documented.

Engaging a qualified accountant or tax professional who specializes in SMSFs can be invaluable during this process. These professionals can provide guidance on complex tax issues, help identify potential deductions, and ensure that all reporting requirements are met. By taking these proactive measures, trustees can significantly reduce the risk of errors and enhance their chances of meeting the due date successfully.

Key Documents Needed for the SMSF Tax Return

When preparing for the SMSF tax return, several key documents are essential to ensure accurate reporting and compliance with ATO regulations. One of the primary documents required is the fund’s financial statements, which should include a comprehensive overview of income, expenses, assets, and liabilities. These statements provide a clear picture of the fund’s financial position and are critical for determining taxable income.

In addition to financial statements, trustees must also gather bank statements for all SMSF accounts. These statements help verify income received from investments and ensure that all transactions are accurately recorded. Furthermore, documentation related to investments—such as share purchase agreements, property valuations, and rental income records—must be compiled to support claims made in the tax return.

Other important documents include minutes from trustee meetings, member contribution records, and any correspondence with the ATO or other regulatory bodies. Collectively, these documents form a comprehensive package that supports the accuracy and integrity of the SMSF tax return.

Common Mistakes to Avoid When Filing the SMSF Tax Return

Filing an SMSF tax return is a complex process that can be fraught with pitfalls if not approached carefully. One common mistake is failing to report all sources of income accurately. Trustees may overlook certain investment income or fail to account for capital gains from asset sales, leading to discrepancies in reported income.

Such oversights can trigger audits or penalties from the ATO. Another frequent error involves misclassifying expenses or failing to keep adequate records to substantiate claims. For example, trustees might incorrectly categorize personal expenses as fund-related expenses or neglect to maintain receipts for deductible items.

This lack of documentation can result in disallowed deductions and increased tax liabilities. Additionally, some trustees may not fully understand their obligations regarding member contributions or pension payments, leading to compliance issues that could have been easily avoided with proper guidance.

Benefits of Meeting the SMSF Tax Return Due Date

Meeting the SMSF tax return due date offers numerous benefits that extend beyond mere compliance with regulatory requirements. One significant advantage is maintaining the fund’s compliance status with the ATO. A compliant fund enjoys concessional tax treatment on earnings and contributions, which can lead to substantial long-term savings for members as they build their retirement nest egg.

Moreover, timely filing fosters a sense of financial discipline within the fund’s management. By adhering to deadlines and maintaining accurate records throughout the year, trustees can gain better insights into their fund’s performance and make informed investment decisions. This proactive approach not only enhances transparency but also builds trust among members who rely on trustees to manage their retirement savings responsibly.

Ultimately, meeting deadlines contributes to a more robust financial strategy that aligns with members’ retirement goals.

Extensions and Penalties for Late SMSF Tax Return Filing

While there are provisions for extensions regarding SMSF tax return filings, it is crucial for trustees to understand how these work and what penalties may apply if deadlines are missed. If an SMSF is registered with a tax agent who lodges returns on behalf of clients, an extension until May 15th may be granted automatically by the ATO. However, this extension is contingent upon timely communication between the trustee and their tax agent; failure to engage a qualified professional may result in losing this opportunity.

On the other hand, if an SMSF fails to lodge its return by either the original or extended due date without reasonable cause, it may face significant penalties imposed by the ATO. These penalties are designed to encourage compliance and can escalate quickly if returns remain outstanding over time. In some cases, repeated failures to meet deadlines may lead to more severe consequences, including potential disqualification of trustees or even deregistration of the SMSF itself.

Tips for Successfully Meeting the SMSF Tax Return Due Date

Successfully meeting the SMSF tax return due date requires careful planning and organization throughout the year. One effective strategy is to establish a regular schedule for reviewing financial records and preparing documentation well in advance of the due date. By setting aside dedicated time each month or quarter to assess financial performance and gather necessary documents, trustees can avoid last-minute scrambles as deadlines approach.

Additionally, leveraging technology can significantly streamline the preparation process. Utilizing accounting software specifically designed for SMSFs can help automate record-keeping tasks and generate reports needed for tax returns efficiently. Furthermore, engaging with a qualified accountant or tax advisor who specializes in SMSFs can provide invaluable insights into best practices for compliance and reporting requirements.

By fostering open communication with these professionals throughout the year, trustees can ensure they remain informed about any changes in legislation or regulations that may impact their obligations. In conclusion, understanding and adhering to the SMSF tax return due date is paramount for trustees aiming to maintain compliance while maximizing their fund’s potential benefits. By taking proactive steps in preparation and avoiding common pitfalls, trustees can navigate this complex landscape effectively while safeguarding their members’ retirement savings.